Paisa Online loan EMI moratorium: All you need to know

The Reserve Bank of India (RBI) clearly mentioned that all lending institutions, including banks and housing finance companies, will have to give its borrowers a three-month moratorium on term loans.

The moratorium was for payment of all instalments falling due between March 1 and May 31, 2020. According to the Reserve Bank, the deferred instalments under the moratorium will include principal and/or interest components, bullet repayments, equated monthly instalments (EMIs) and credit card dues.

Here are the details on loan EMI moratorium released by Paisa Online :

The prevailing situation may pose a huge challenge for people at large. As a measure of solidarity, RBI has permitted all Indian Banks/Indian Financial Institutions to offer it’s customers up to 3 months moratorium on their EMI payments falling due between March 1, 2020 to May 31, 2020.

All Paisa Online customers who have availed of retail instalment loan or any other retail credit facilities prior to March 1, 2020 are eligible. Customers having overdues prior to March 1, 2020 may also opt for the moratorium, and their requests shall be considered by the bank based on its merits.

All agri loans (Kisan Gold Card) and microfinance customers under the Bank’s 'Sustainable Livelihood Initiative' are also eligible. Corporate as well as SME customers are also eligible.

If you choose EMI moratorium,

- Bank will not ask for any EMI Payment till May 31, 2020.

- Interest will continue to accrue on the principal outstanding for the period of the moratorium at the contracted rate of the loan.

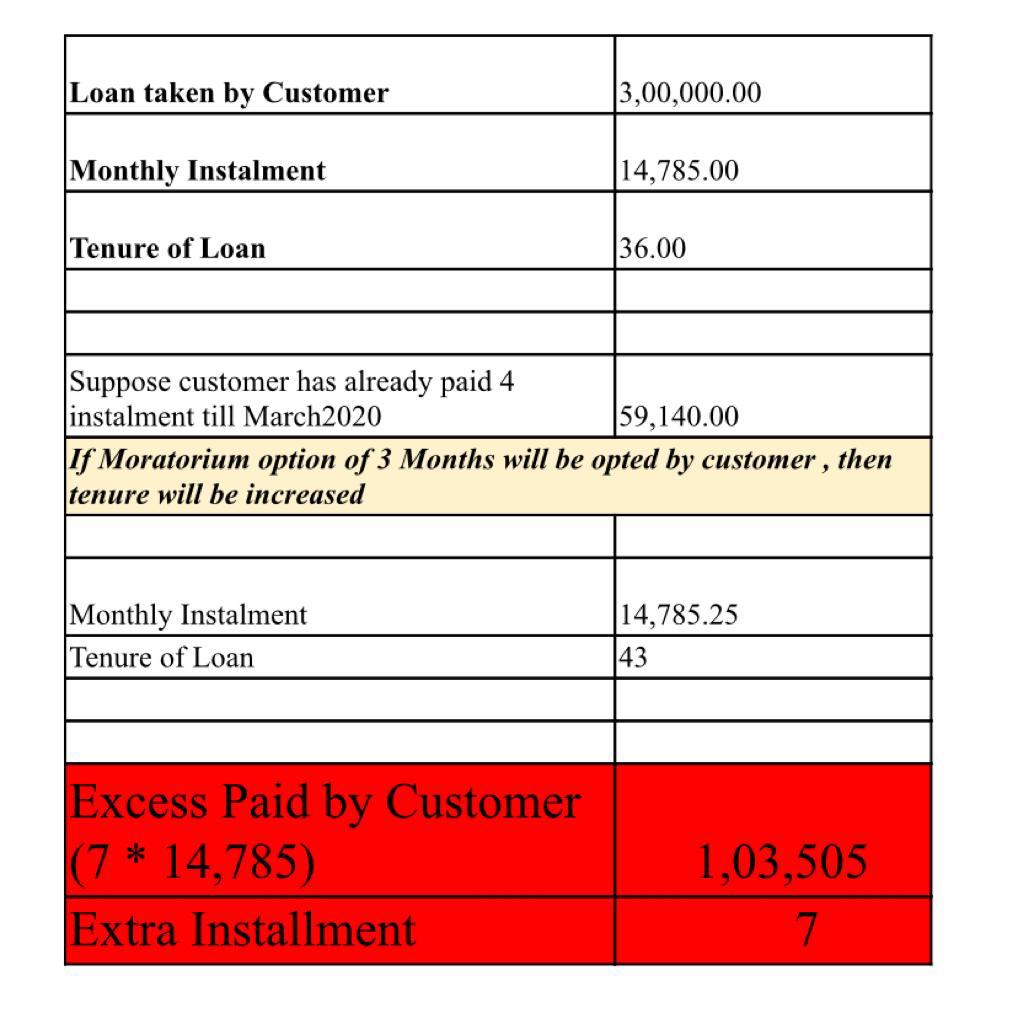

- The loan tenure will get extended by the corresponding period for which the moratorium has been availed.

- For example, if the EMI for the month of Mar’2020 has been paid and moratorium for April and May 2020 has been availed, then the loan tenure will be extended by 2 months.

- Bank will not ask for any EMI Payment till May 31, 2020.

- Interest will continue to accrue on the principal outstanding for the period of the moratorium at the contracted rate of the loan.

- The loan tenure will get extended by the corresponding period for which the moratorium has been availed.

- For example, if the EMI for the month of Mar’2020 has been paid and moratorium for April and May 2020 has been availed, then the loan tenure will be extended by 2 months.

If you do not want the EMI moratorium, no further action is required from your side. However, if you skip your EMI payment during this period, it is understood that you require EMI moratorium till May 2020.

Opting for the moratorium is entirely the customers’ choice. We understand that all our customers may not opt for the Moratorium given that there is an additional levy of interest payable under the terms of the Moratorium. If you wish to opt for the moratorium, the bank will refund the EMI debited and register your Loan account under the Moratorium process.

If you avail the EMI moratorium, there will be a levy of interest at the contracted rate of the loan for the period of EMI moratorium on the loan outstanding. Such interest will be collected by extending the original tenor of the loan accordingly.

You will have to provide your consent to the bank through any of the following ways:

- Call on this number and follow the instructions – 022-50042333, 022-50042211, or

- Submit your request in a few clicks here

- Call on this number and follow the instructions – 022-50042333, 022-50042211, or

- Submit your request in a few clicks here

Yes, you can opt for EMI moratorium for each loan that you have availed from us. Please remember that additional interest for the EMI moratorium period will be applicable for each loan separately.

You can avail of the moratorium benefits for the unpaid EMIs. Please follow the process given above for availing the moratorium

No. Opting for the EMI moratorium will not affect your Credit Rating or Score.

Yes, the moratorium is available on Credit Card outstanding and Loans availed on Credit Cards for payments due from March 1, 2020 till May 31, 2020.

The moratorium allows you to defer the payment till May 31, 2020. You are required to pay the minimum amount due or total outstanding and accrued interest charges on the due date after May 31, 2020.

Yes. All retail credit card customers will be deemed eligible for the moratorium if they are regular with their payments on or before 01st March'20 on their credit card outstanding and loans taken on the credit card

To avail the credit card moratorium,

(a) voluntarily defer paying the outstanding during this period i.e. make NIL payment

(b) turn off Auto Pay (in case the same is currently availed) through net banking / mobile banking to avail the benefit of the moratorium and reactivate the same post the end of moratorium period

(a) voluntarily defer paying the outstanding during this period i.e. make NIL payment

(b) turn off Auto Pay (in case the same is currently availed) through net banking / mobile banking to avail the benefit of the moratorium and reactivate the same post the end of moratorium period

Yes, interest will be levied as per the contracted rate on the card. Opting for 3 months moratorium allows you to defer the payment of your credit card dues and loan instalments taken on credit card till May 31, 2020. We encourage customers to make full payments towards the outstanding wherever possible to avoid / minimise levy of interest charges for this period.

It must be noted that the moratorium is a deferment of payment and not a waiver of interest. You are required to pay the minimum amount due or total outstanding along with accrued interest charges on the due date after May 31, 2020.